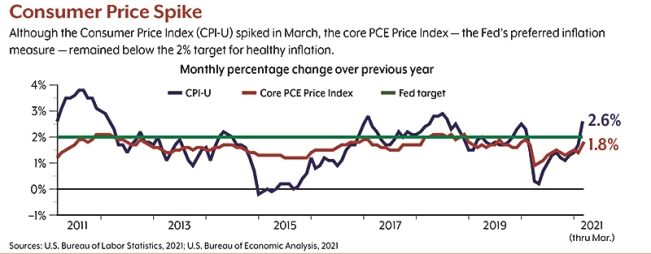

one-month increase since August 2012. Over the previous 12 months, the increase was 2.6%, the highest

year-over-year inflation rate since August 2018. (By contrast, inflation in 2020 was just 1.4%.)1

The annual increase in CPI-U — often called headline inflation — was due in part to the fact that the index

dropped in March 2020, the beginning of the U.S. economic shutdown in the face of the COVID-19

pandemic. Thus, the current 12-month comparison is to an unusual low point in prices. The index dropped

even further in April 2020, and this “base effect” will continue to skew annual data through June.2

The monthly March increase, which followed a substantial 0.4% increase in February, is more indicative of

the current situation. Economists expect inflation numbers to rise for some time. The question is whether

they represent a temporary anomaly or the beginning of a more worrisome inflationary trend.3

Measuring Prices

In considering the prospects for inflation, it’s important to understand some of the measures that

economists use.

CPI-U measures the price of a fixed market basket of goods and services. As such, it is a good measure of

prices consumers pay if they buy the same items over time, but it does not reflect changes in consumer

behavior and can be unduly influenced by extreme increases in specific categories. Nearly half of the

March increase was due to gasoline prices, which rose 9.1% during the month, in part because of

production interruptions caused by severe winter storms in Texas.4 Core CPI, which strips out volatile food

and energy prices, rose 0.3% in March and just 1.6% year over year.5

In setting economic policy, the Federal Reserve prefers a different inflation measure called the Personal

Consumption Expenditures (PCE) Price Index, which is even broader than the CPI and adjusts for changes

in consumer behavior — i.e., when consumers shift to purchase a different item because the preferred item

is too expensive. More specifically, the Fed looks at core PCE, which rose 0.4% in March and 1.8% for the

previous 12 months, slightly higher than core CPI but still lower than the Fed’s target of 2% for healthy

economic growth.6

A Hot Economy

Based on the core numbers, inflation is not yet running high, but there are clear inflationary pressures on

the U.S. economy. Loose monetary policies by the central bank and trillions of dollars in government

stimulus could create excess money supply as the economy reopens. Pent-up consumer demand for goods

and services is likely to rise quickly, fueled by stimulus payments and healthy savings accounts built by

those who worked through the pandemic with little opportunity to spend their earnings. Businesses that

shut down or cut back when the economy was closed may not be able to ramp up quickly enough to meet

demand. Supply-chain disruptions and higher costs for raw materials, transportation, and labor have

already led some businesses to raise prices.7

According to the April Wall Street Journal Economic Forecasting Survey, gross domestic product (GDP) is

expected to increase at an annualized rate of 8.4% in the second quarter of 2021 and by 6.4% for the year —

a torrid annual growth rate that would be the highest since 1984. As with the base effect for inflation, it’s

important to keep in mind that this follows a 3.5% GDP decline in 2020. Even so, the expectation is for a

hot economy through the end of the year, followed by solid 3.2% growth in 2022 before slowing down to

2.4% in 2023.8-9

Three Scenarios

Will the economy get too hot to handle? Though all economists expect inflation numbers to rise in the near

term, there are three different views on the potential long-term effects.

The most sanguine perspective, held by many economic policymakers including Federal Reserve Chair

Jerome Powell and Treasury Secretary Janet Yellen, is that the impact will be short-lived and due primarily

to the base effect with little or no long-term consequences.10 Inflation has been abnormally low since the

Great Recession, consistently lagging the Fed’s 2% target. In August 2020, the Federal Open Market

Committee (FOMC) announced that it would allow inflation to run moderately above 2% for some time in

order to create a 2% average over the longer term. Given this policy, the FOMC is unlikely to raise interest

rates unless core PCE inflation runs well above 2% for an extended period.11 The mid-March FOMC

projection sees core PCE inflation at just 2.2% by the end of 2021, and the benchmark federal funds rate

remaining at 0.0% to 0.25% through the end of 2023.12

The second view believes that inflation may last longer, with potentially wider consequences, but that any

effects will be temporary and reversible. The third perspective is that inflation could become a more

extended problem that may be difficult to control. Both camps project that the base effects will be amplified

by “demand-pull” inflation, where demand exceeds supply and pushes prices upward. The more extreme

view believes this might lead to a “cost-push” effect and inflationary feedback loop where businesses, faced

with less competition and higher costs, would raise prices preemptively, and workers would demand higher

wages in response.13

Maintaining Perspective

Although it’s too early to tell whether current inflation numbers will lead to a longer-term shift, you can

expect higher prices for some items as the economy reopens. Consumers don’t like higher prices, but it’s

important to keep these increases in perspective. Gasoline, jet fuel, and other petroleum prices are rising

after being deeply depressed during the pandemic. Airline ticket prices are increasing but remain below

their pre-pandemic level. Used cars and trucks are more expensive than before the pandemic, but clothing

is still cheaper.14 Food is up 3.5% over the last 12 months, a significant increase but not extreme for prices

that tend to be volatile.15

For now, it may be helpful to remember that “headline inflation” does not always represent the larger

economy. And with interest rates near zero, the Federal Reserve has plenty of room to make any

necessary adjustments to monetary policy.

Projections are based on current conditions, are subject to change, and may not come to pass.

1, 5, 15) U.S. Bureau of Labor Statistics, 2021

2-4, 7) The Wall Street Journal, April 13, 2021

6, 9) U.S. Bureau of Economic Analysis, 2021

8) The Wall Street Journal Economic Forecasting Survey, April 2021

10, 13) Bloomberg, March 29, 2021

11) The Wall Street Journal, April 14, 2021

12) Federal Reserve, 2021

14) The New York Times, April 13, 2021